PRE 14C: Preliminary information statement not related to a contested matter or merger/acquisition

Published on February 7, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

|

þ

|

Preliminary Information Statement

|

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

o

|

Definitive Information Statement

|

SILVER HORN MINING LTD.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

þ

|

No fee required.

|

|||

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|||

|

(1)

|

Title of each class of securities to which transaction applies:

|

|||

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|||

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

$ per share as determined under Rule 0-11 under the Exchange Act.

|

||||

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|||

|

(5)

|

Total fee paid:

|

|||

|

o

|

Fee paid previously with preliminary materials.

|

|||

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|||

|

(1)

|

Amount previously paid:

|

|||

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|||

|

(3)

|

Filing Party:

|

|||

|

(4)

|

Date Filed:

|

|||

1

SILVER HORN MINING LTD.

18 Falcon Hills Dr.

Highlands Ranch, Colorado 80126

INFORMATION STATEMENT

PURSUANT TO SECTION 14

OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

AND REGULATION 14C AND SCHEDULE 14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A PROXY

Highlands Ranch, Colorado

*, 2014

This information statement has been mailed on or about *, 2014 to the stockholders of record on January 21, 2014 of Silver Horn Mining Ltd., a Delaware corporation (the “Company”) in connection with certain actions taken by the written consent by the majority stockholders of the Company, dated as of January 21, 2014, pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The actions to be taken pursuant to the written consent shall be taken on or about *, 2014, 20 days after the mailing of this Information Statement. This information statement also serves as the notice required by Section 228 of the General Corporation Law of the State of Delaware of the taking of a corporate action without a meeting by less than unanimous written consent of the Company’s shareholders.

The written consent approved:

|

|

(1)

|

The Silver Horn Mining Ltd. 2014 Equity Incentive Plan and

|

|

|

(2)

|

Entry into an Agreement and Plan of Merger with the Company’s wholly owned subsidiary Great West Resources, Inc., a Nevada corporation (“Great West”) for the purpose of changing the state of incorporation of the Company to Nevada from Delaware.

|

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

|

By Order of the Board of Directors,

|

||

|

/s/ Patrick Avery

|

||

|

Patrick Avery

|

||

|

Chairman of the Board

|

2

SILVER HORN MINING LTD.

18 Falcon Hills Drive

Highlands Ranch, Colorado 80126

(720) 413-4520

INFORMATION STATEMENT

GENERAL INFORMATION

Silver Horn Mining Ltd. (the “Company”) is a Delaware corporation with its principal executive offices located at 18 Falcon Hills Drive, Highlands Ranch, Colorado 80126. The Company’s telephone number is (720) 413-4520. This Information Statement is being sent to the Company’s stockholders (the “Stockholders”) by the Board of Directors to notify them about action that the holders of a majority of the Company’s outstanding voting capital stock have taken by written consent, in lieu of a special meeting of the Stockholders. The action was taken on January 21, 2014, and will be effective on *, 2014, approximately 20 days after the mailing of this Information Statement.

On January 21, 2014, the Board of Directors of the Company approved the above-mentioned action and authorized submission of the matter for the approval of the Stockholders. The Stockholders approved the action by written consent in lieu of a meeting on January 21, 2014, in accordance with the Delaware General Corporation Law (“DGCL”). Accordingly, neither your vote nor your consent is required and neither is being solicited in connection with the approval of the action.

January 21, 2014 is the record date (the “Record Date”) for the determination of stockholders who are entitled to receive this Information Statement.

This Information Statement has been filed with the Securities and Exchange Commission and is being furnished pursuant to Section 14 of the Exchange Act to the Stockholders of the common stock, par value $0.0001 per share (the “Common Stock”), of the Company, to notify such Stockholders of the following:

On January 21, 2014, the holders of the majority of the voting capital stock of the Company (the “Majority Shareholders”) took action in lieu of a special meeting of Stockholders to (i) approve the Silver Horn Mining Ltd. 2014 Equity Incentive Plan (the “Plan”), a copy of which is annexed hereto as Appendix A, and (ii) authorize the Company to enter into an Agreement and Plan of Merger, a copy of which is annexed hereto as Appendix B (the “Merger”) with its newly-formed wholly-owned subsidiary, Great West Resources, Inc., a Nevada corporation (“Great West”) for the purpose of changing the state of incorporation of the Company to Nevada from Delaware (collectively, the “Proposals”).

Upon the consummation of the Merger, the Company will be merged with and into Great West with Great West continuing as the surviving corporation. Following the closing of the Merger, the Company’s corporate existence shall be governed by the laws of the State of Nevada and the Amended and Restated Articles of Incorporation, as amended to date, of Great West (sometimes referred to as the “Nevada Articles”), a copy of which is annexed hereto as Appendix C, shall be the Articles of Incorporation of the Company and the Bylaws of Great West, a copy of which is annexed hereto as Appendix D, shall be the Bylaws of the Company.

The Proposals were unanimously approved by our Board of Directors (sometimes referred to as the “Board”) on January 21, 2014.

This Information Statement contains a brief summary of the material aspects of each of the Proposals approved by the Board of Directors and the Majority Shareholders.

3

ABOUT THE INFORMATION STATEMENT

WHAT IS THE PURPOSE OF THE INFORMATION STATEMENT?

This Information Statement is being furnished to you pursuant to Section 14 of the Exchange Act to notify the Company’s Stockholders as of the close of business on the Record Date of a corporate action taken by the Majority Shareholders.

WHO IS ENTITLED TO NOTICE?

Each outstanding share of the Company’s voting securities on the close of business on the Record Date is entitled to notice of each matter voted on by the Stockholders. Stockholders as of the close of business on the Record Date that held the authority to cast votes in excess of fifty percent (50%) of the Company’s outstanding voting power have voted in favor of the Merger. Under Delaware corporate law, stockholder approval may be taken by obtaining the written consent and approval of more than 50% of the holders of voting stock in lieu of a meeting of the Stockholders.

WHAT CONSTITUTES THE VOTING SHARES OF THE COMPANY?

The voting power entitled to vote on the Merger consists of the vote of the holders of a majority of the Company’s voting securities as of the Record Date. As of the Record Date, the Company’s voting securities consisted of 226,646,288 shares of Common Stock, 3,000,000 shares of Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”) and 1,000,000 shares of Series D Convertible Preferred Stock, par value $0.0001 per share (the “Series D Preferred Stock”). Each share of Series A Preferred Stock is entitled to 250 votes per share on matters submitted to the Stockholders. Each share of Series D Preferred Stock is entitled to 1 vote per share on matters submitted to the Stockholders.

WHAT CORPORATE MATTERS WILL THE STOCKHOLDERS VOTE FOR, AND HOW WILL THEY VOTE?

Stockholders holding a majority of our outstanding voting securities have voted in favor of the following Proposals:

1. TO APPROVE THE SILVER HORN MINING LTD. 2014 EQUITY INCENTIVE PLAN.

2. TO AUTHORIZE THE REINCORPORATION RESULTING IN A CHANGE OF THE COMPANY’S DOMICILE TO NEVADA FROM DELAWARE.

WHAT VOTE IS REQUIRED TO APPROVE THE PROPOSAL?

No further vote is required for approval of the Plan or approval of the Merger.

4

OUTSTANDING VOTING SECURITIES

As of the Record Date, the Company’s authorized capital consisted of 760,000,000 shares of capital stock, 750,000,000 of which are authorized as Common Stock and 10,000,000 of which are authorized as Preferred Stock. As of the Record Date, 226,646,288 shares of Common Stock were issued and outstanding. Of the 10,000,000 shares of authorized Preferred Stock, (i) 3,000,000 shares are designated as Series A Preferred Stock, of which all shares of such Series A Preferred Stock are issued and outstanding and (ii) 4,000,000 are designated as Series D Preferred Stock, of which 1,000,000 shares of such Series D Preferred Stock are issued and outstanding.

Each share of outstanding Common Stock is entitled to one vote on matters submitted to the Stockholders. Each share of Series A Preferred Stock is entitled to 250 votes per share on matters submitted to the Stockholders. Each share of outstanding Series D Preferred Stock is entitled to one vote on matters submitted to the Stockholders.

The following shareholders voted in favor of the Proposal:

|

Name

|

Number of Votes

|

|||

|

Auracana, LLC(1)

|

750,000,000

|

|||

|

(1)

|

Represents 3,000,000 shares of the Company’s Series A Preferred Stock. Each share of Series A Preferred Stock is entitled to 250 votes per share on matters submitted to the Stockholders.

|

Pursuant to Rule 14c-2 under the Exchange Act, the proposals will not be adopted until a date at least 20 days after the date on which this Information Statement has been mailed to the Stockholders. The Company anticipates that the actions contemplated herein will be effected on or about the close of business on February *, 2014.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

This Information Statement will serve as written notice to stockholders pursuant to the laws of the State of Delaware.

5

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following tables sets forth, as of February 6, 2014, the number of and percent of the Company’s voting securities beneficially owned by: (1) all directors and nominees, naming them; (2) our executive officers; (3) our directors and executive officers as a group, without naming them; and (4) persons or groups known by us to own beneficially 5% or more of our common stock.

A person is deemed to be the beneficial owner of securities that can be acquired by him within 60 days from February 6, 2014 upon the exercise of options, warrants or convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants or convertible securities that are held by him, but not those held by any other person, and which are exercisable within 60 days of February 6, 2014 have been exercised and converted.

|

Title of Class

|

Name of Beneficial Owner

|

Shares Beneficially Owned (1)

|

Percentage of Class (1)

|

|||||||

|

5% Owners

|

||||||||||

|

Common Stock

|

Michael Baybak

|

13,541,667

|

5.97

|

%

|

||||||

|

Common Stock

|

Michael Brauser

|

24,390,521

|

(2)

|

10.76

|

%

|

|||||

|

Common Stock

|

Barry Honig

|

22,641,964

|

(3)

|

9.99

|

%

|

|||||

|

Common Stock

|

Philip Frost

|

19,000,000

|

(4)

|

8.38

|

%

|

|||||

|

Common Stock

|

Sandor Master Capital Fund L.P. (5)

|

16,401,900

|

7.24

|

%

|

||||||

|

Series A Preferred Stock

|

Glenn Kesner

|

3,000,000

|

(6)

|

100.00

|

%

|

|||||

|

Series D Preferred Stock

|

Michael Brauser

|

500,000

|

(7)

|

50.00

|

%

|

|||||

|

Series D Preferred Stock

|

Barry Honig

|

500,000

|

(7)

|

50.00

|

%

|

|||||

|

Officers and Directors

|

||||||||||

|

Common Stock

|

Patrick Avery

|

0

|

(8)

|

0

|

%

|

|||||

|

Common Stock

|

Mohit Bhansali

|

4,500,000

|

(9)

|

1.99

|

%

|

|||||

|

Common Stock

|

Glenn Kesner (10)

|

219,863

|

*

|

%

|

||||||

|

Series A Preferred Stock

|

Glenn Kesner

|

3,000,000

|

(6)

|

100.00

|

%

|

|||||

|

Common Stock

|

Andrew Uribe

|

4,500,000

|

(9)

|

1.99

|

%

|

|||||

|

All Officers and Directors (4 people)

|

||||||||||

|

Common Stock

|

9,219,863

|

(9)(10)

|

4.07

|

%

|

||||||

|

Series A Preferred Stock

|

3,000,000

|

(6)

|

100

|

%

|

||||||

|

(1)

|

The percentage of common stock and the shares beneficially owned are calculated based on 226,646,288 shares of common stock issued and outstanding on February 6, 2014. Following the Merger, each share of common stock, Series A Preferred Stock and Series D Preferred Stock outstanding as set forth herein shall be equal to 1/150 of such outstanding common stock, Series A Preferred Stock and Series D Preferred Stock.

|

|

(2)

|

Does not include (i) 2,500,000 shares of common stock issuable upon conversion of 500,000 shares of Series D Preferred Stock and (ii) 17,750,000 shares of common stock issuable upon exercise of warrants. The holder of Series D Preferred Stock may not receive shares of the Company’s common stock such that the number of shares of common stock held by it and its affiliates after conversion exceeds 9.99% of the then issued and outstanding shares of common stock. The holder of the warrants may not receive shares of the Company’s common stock such that the number of shares of common stock held by it and its affiliates after exercise of warrants exceeds 9.99% of the then issued and outstanding shares of common stock.

|

6

|

(3)

|

Includes (i) 4,664,830 shares of common stock held by Barry Honig, (ii) 8,326,146 shares of common stock held by GRQ Consultants, Inc. 401K (“GRQ 401K”), (iii) 300,000 shares of common stock held by GRQ Consultants, Inc. (“GRQ”), (iv) 8,700,000 shares of common stock issuable to Barry Honig upon exercise of warrants at an exercise price of $0.05 per share, (v) 300,000 shares of common stock issuable to GRQ upon exercise of warrants at an exercise price of $0.05 per share and (vi) 373,426 shares of common stock issuable to GRQ 401K upon exercise of warrants at an exercise price of $0.05 per share. Does not include (i) 6,649,012 shares of common stock issuable upon exercise of warrants held by GRQ 401K and 2,500,000 shares of common stock issuable upon conversion of 500,000 shares of Series D Preferred Stock held by Barry Honig. The holder of Series D Preferred Stock may not receive shares of the Company’s common stock such that the number of shares of common stock held by it and its affiliates after conversion exceeds 9.99% of the then issued and outstanding shares of common stock. The holder of warrants may not receive shares of the Company’s common stock such that the number of shares of common stock held by it and its affiliates after exercise of the warrants exceeds 9.99% of the then issued and outstanding shares of common stock. Barry Honig is the trustee and a control person of GRQ 401K and the President and a control person of GRQ and in such positions is deemed to hold voting and dispositive power over securities of the Company held by GRQ 401K and GRQ, respectively.

|

|

(4)

|

Includes 16,000,000 shares of common stock held by Frost Gamma Investments Trust. Dr. Philip Frost is the trustee and a control person of Frost Gamma Investments Trust and in such positions is deemed to hold voting and dispositive power over securities of the Company held by the Frost Gamma Investments Trust.

|

|

(5)

|

John Lemak is the manager and a control person of Sandor Master Capital Fund L.P. and in such position is deemed to hold voting and dispositive power over securities of the Company held by Sandor Master Capital Fund L.P.

|

|

|

(6)

|

Includes 3,000,000 shares of Series A Preferred Stock held by Auracana, LLC. Glenn Kesner is the president and a control person of Auracana, LLC and in such position is deemed to hold voting and dispositive power over securities of the Company held by Auracana LLC. Each share of Series A Preferred Stock is convertible into shares of common stock on a one-to-one basis and has the voting power of 250 shares of common stock.

|

|

|

(7)

|

Each share of Series D Preferred Stock is convertible into shares of common stock on a one-to-five basis and has the voting power of 1 share of common stock.

|

|

|

(8)

|

Does not include an option to purchase up to 7.5% of the outstanding common stock calculated on a post-Transaction pro forma basis at a per share price of $0.0001, which shall vest as follows: (i) 10% immediately on January 21, 2014, (ii) 45% on January 21, 2015 and (iii) the remaining 45% on January 21, 2016. "Transaction" is defined as (a) the consummation of a private placement of the Company’s securities in which the Company receives gross proceeds of at least $1,000,000 and (b) the acquisition of at least fifty lease holdings in the Holbrook Basin in Arizona.

|

|

|

(9)

|

Includes option to purchase up to 4,500,000 shares of common stock.

|

|

|

(10)

|

Includes 219,863 shares of common stock held by Auracana, LLC. Glenn Kesner is the president and a control person of Auracana, LLC and in such position is deemed to hold voting and dispositive power over securities of the Company held by Auracana LLC.

|

7

EXECUTIVE COMPENSATION

The following table summarizes the overall compensation earned over each of the past two fiscal years ending December 31, 2013 by each person who served as our principal executive officer during fiscal 2013.

Summary Compensation Table

|

Name and

Principal Position

|

Year

|

Salary

($)

|

Stock

Awards

($) (1)

|

All Other

Compensation

($)

|

Total ($)

|

|||||||||||||

|

Daniel Bleak (2)

|

2012

|

12,775

|

3,500,000

|

(2)

|

—

|

3,512,775

|

||||||||||||

|

(Former Chief Executive Officer, Chief Financial Officer and Chairman)

|

2013

|

0

|

0

|

|

—

|

0

|

||||||||||||

|

Andrew Uribe

|

2012

|

-

|

-

|

—

|

-

|

|||||||||||||

|

(Former Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer; Current Director)

|

2013

|

0

|

0

|

—

|

0

|

|||||||||||||

(1) Reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. All stock awards have been adjusted for our 1:150 reverse stock split effective August 25, 2009, our 2:1 forward exchange effective April 21, 2010 and our 2:1 stock dividend issued to certain stockholders on December 31, 2010.

(2) In connection with his appointment on May 2, 2011, Daniel Bleak was awarded 10,000,000 shares of common stock and a five year option to purchase 30,000,000 shares of our common stock. The option was exercisable for cash or shares of common stock at an exercise price of $0.05 per share as to one third of the number of shares granted on each of the first, second and third anniversaries of the date of grant. The option was cancelled on February 21, 2012 and the shares were cancelled on November 8, 2013. Mr. Bleak was issued 25,000,000 shares on February 21, 2012 as compensation for his services. Amount equals grant date fair value determined for financial reporting purposes in accordance with generally accepted accounting principles. These shares were cancelled on November 8, 2013 in connection with Mr. Bleak's resignation from all of his positions with the Company.

Agreements and Option Grants

Effective April 3, 2011 we entered into a consulting agreement with Mr. Bleak that terminated on June 30, 2011, pursuant to which we paid Mr. Bleak $5,000 a month for three months as compensation for his professional services.

On June 1, 2011, we entered into a one year services and employee leasing agreement with MJI pursuant to which it made available to us six of its employees, including Mr. Bleak, for the purpose of performing management, operations, legal, accounting and resource location services. The agreement stipulated that we pay MJI $15,000 a month and the six employees an aggregate of $11,000 a month under this agreement in each of June and July 2011, provided however, that such payments may be adjusted for additional services. The agreement was amended on August 1, 2011 such that, commencing in August 2011, we were to pay MJI $25,000 a month and the six employees an aggregate of $11,000 a month, as such payments may be adjusted for additional services. The agreement was further amended on October 1, 2011 to extend its term to five years. Pursuant to this agreement, from the period from June 1, 2011 through December 31, 2011, we paid MJI a total of $155,000, we directly paid the six employees $169,471 and we paid certain subcontractors $17,255. We paid Mr. Bleak a total of $75,828 pursuant to this agreement. For the fiscal year December 31, 2012, we directly paid the six employees $14,565 and we paid certain subcontractors $3,083. We paid Mr. Bleak a total of $12,775 pursuant to this agreement. Mr. Bleak resigned from all positions with the Company on November 8, 2013.

On November 8, 2013, the Company entered into a debt forgiveness agreement with MJI, pursuant to which MJI forgave (i) $1,264,253 owed to it pursuant to all outstanding invoices less $175,000 and (ii) all other debt incurred by the Company from January 1, 2011 through the November 8, 2013. The Company agreed to pay MJI $175,000 upon the closing of any future purchase of all or substantially all of the assets of a privately held or public operating company and simultaneous capital raising transaction (the “Financing”) as (i) a cash payment, (ii) conversion into the applicable dollar amount of securities issued by the Company in the Financing upon the same terms provided to the other investors in the Financing or (iii) a combination of (i) and (ii). At the current time, the Company has not entered into any definitive agreements in connection with a Financing.

In connection with his appointment on May 2, 2011, we awarded Mr. Bleak 10,000,000 shares of common stock and a five year option to purchase 30,000,000 shares of our common stock. The option was exercisable for cash or shares of common stock at an exercise price of $0.05 per share as to one third of the number of shares granted on each of the first, second and third anniversaries of the date of grant. The option was cancelled on February 21, 2012. Also on February 21, 2012 we issued Mr. Bleak 25,000,000 shares as compensation for his services. Mr. Bleak subsequently sold 500,000 of these shares.

8

On November 8, 2013, the Company entered into an agreement to cancel all 34,500,000 shares of common stock held by Mr. Bleak pursuant to the terms of a cancellation and recapitalization agreement.

Compensation Committee Interlocks and Insider Participation

The Company does not have a compensation committee. During the fiscal year ended December 31, 2013, each of the members of the Board of Directors participated in deliberations of the Board of Directors concerning executive officer compensation. Mr. Bleak served as the Company’s sole officer from January 1, 2013 through his resignation on November 8, 2013. Mr. Uribe was appointed as the Company’s sole officer on November 8, 2013.

Director Compensation

The compensation paid to Mr. Bleak and Mr. Uribe for the years ending December 31, 2012 and 2013 is fully set forth above. Mr. Eckersley and Mr. Wilkins did not receive any compensation for their services as our directors for the years ending December 31, 2012 and 2013 and Mr. Bhansali did not receive any compensation for his services as a director for the year ending December 31, 2013. Mr. Bleak, Mr. Wilkins and Mr. Eckersley resigned from all positions with the Company on November 8, 2013.

PROPOSAL NO. 1

TO APPROVE THE SILVER HORN MINING LTD.

2014 INCENTIVE COMPENSATION PLAN

The Board of Directors recommends that the shareholders approve the Silver Horn Mining Ltd. Equity Incentive Plan (the “Plan”).

The purpose of the Plan is to promote the success of the Company and to increase stockholder value by providing an additional means through the grant of awards to attract, motivate, retain and reward selected employees and other eligible persons.

A copy of the Plan is attached hereto as Appendix A.

Administration

The Plan shall be administered by and all awards under the Plan shall be authorized by the Administrator. The “Administrator” means the Board of Directors or one or more committees appointed by the Board of Directors or another committee (within its delegated authority) to administer all or certain aspects of the Plan. Any such committee shall be comprised solely of one or more directors or such number of directors as may be required under applicable law. A committee may delegate some or all of its authority to another committee so constituted. The Board or a committee comprised solely of directors may also delegate, to the extent permitted by applicable law, to one or more officers of the Company, its powers under the Plan (a) to designate “Eligible Persons” who will receive grants of awards under the Plan, and (b) to determine the number of shares subject to, and the other terms and conditions of, such awards. The Board may delegate different levels of authority to different committees with administrative and grant authority under the Plan. Unless otherwise provided in the bylaws of the Company or the applicable charter of any Administrator: (a) a majority of the members of the acting Administrator shall constitute a quorum, and (b) the affirmative vote of a majority of the members present assuming the presence of a quorum or the unanimous written consent of the members of the Administrator shall constitute due authorization of an action by the acting Administrator.

9

With respect to awards intended to satisfy the requirements for performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended, the Plan shall be administered by a committee consisting solely of two or more outside directors (as this requirement is applied under Section 162(m) of the Code); provided, however, that the failure to satisfy such requirement shall not affect the validity of the action of any committee otherwise duly authorized and acting in the matter. Award grants, and transactions in or involving awards, intended to be exempt under Rule 16b-3 under the Exchange Act, must be duly and timely authorized by the Board or a committee consisting solely of two or more non-employee directors (as this requirement is applied under Rule 16b-3 promulgated under the Exchange Act). To the extent required by any applicable stock exchange, the Plan shall be administered by a committee composed entirely of independent directors (within the meaning of the applicable stock exchange). Awards granted to non-employee directors shall not be subject to the discretion of any officer or employee of the Corporation and shall be administered exclusively by a committee consisting solely of independent directors.

Types of Awards

The types of awards that may be granted under the Plan are:

Stock Options. A stock option is the grant of a right to purchase a specified number of shares of Common Stock during a specified period as determined by the Administrator. An option may be intended as an incentive stock option within the meaning of Section 422 of the Code (an “ISO”) or a nonqualified stock option (an option not intended to be an ISO). The maximum term of each option (ISO or nonqualified) shall be ten (10) years. The per share exercise price for each option shall be not less than 100% of the Fair Market Value of a share of Common Stock on the date of grant of the option, except as otherwise determined by the Administrator. When an option is exercised, the exercise price for the shares to be purchased shall be paid in full in cash or such other method permitted by the Administrator consistent with the Plan.

Stock Appreciation Rights. A stock appreciation right or “SAR” is a right to receive a payment, in cash and/or Common Stock, equal to the number of shares of Common Stock being exercised multiplied by the excess of (i) the Fair Market Value of a share of Common Stock on the date the SAR is exercised, over (ii) the Fair Market Value of a share of Common Stock on the date the SAR was granted as specified in the applicable award agreement. The maximum term of a SAR shall be ten (10) years.

Restricted Shares. Restricted shares are shares of Common Stock subject to such restrictions on transferability, risk of forfeiture and other restrictions, if any, as the Administrator may impose, which restrictions may lapse separately or in combination at such times, under such circumstances (including based on achievement of performance goals and/or future service requirements), in such installments or otherwise, as the Administrator may determine at the date of grant or thereafter. Except to the extent restricted under the terms of the Plan and the applicable award agreement relating to the restricted stock, a participant granted restricted stock shall have all of the rights of a shareholder, including the right to vote the restricted stock and the right to receive dividends thereon (subject to any mandatory reinvestment or other requirement imposed by the Administrator).

Restricted Share Units. A restricted share unit, or “RSU”, represents the right to receive from the Company on the respective scheduled vesting or payment date for such RSU, one share of Common Stock. An award of RSUs may be subject to the attainment of specified performance goals or targets, forfeitability provisions and such other terms and conditions as the Administrator may determine, subject to the provisions of this Plan. At the time an award of RSUs is made, the Administrator shall establish a period of time during which the restricted share units shall vest and the timing for settlement of the RSU.

Cash Awards. The Administrator may, from time to time, subject to the provisions of the Plan and such other terms and conditions as it may determine, grant cash bonuses. Cash awards shall be awarded in such amount and at such times during the term of the Plan as the Administrator shall determine.

Other Awards. The other types of awards that may be granted under the Plan include: (a) stock bonuses, performance stock, performance units, dividend equivalents, or similar rights to purchase or acquire shares, whether at a fixed or variable price or ratio related to the Common Stock, upon the passage of time, the occurrence of one or more events, or the satisfaction of performance criteria or other conditions, or any combination thereof; or (b) any similar securities with a value derived from the value of or related to the Common Stock and/or returns thereon.

10

Shares Authorized for Issuance

The maximum number of shares of Common Stock that may be delivered pursuant to awards granted to Eligible Persons under the Plan may not exceed 34,000,000 shares of Common Stock as adjusted in a single adjustment for a Plan Increase Event (as defined below) and certain other adjustments (the “Share Limit”). Notwithstanding the foregoing, the Share Limit shall automatically increased upon the occurrence of the Plan Increase Event such that the Share Limit upon such occurrence shall be equal to 34,000,000 plus the number of shares of Common Stock as shall be equal to fifteen (15%) percent of the number of shares of Common Stock issued or issuable as a result of the Plan Increase Event. “Plan Increase Event” shall mean the issuance not later than sixty (60) days following the date of shareholder approval of the Plan in connection with (i) a private placement of the Company’s securities in which the Company receives gross proceeds of at least One Million Dollars ($1,000,000) and (ii) an acquisition of at least 50 mining leases and/or claims in the Holbrook Basin in Arizona. For the absence of doubt the number of shares of Common Stock issued or issuable as a result of the Plan Increase Event shall mean the number of shares of Common Stock issued and outstanding after giving effect to issuances of securities by the Company in connection with the Plan Increase Event including shares of Common Stock for which the Company’s warrants and preferred stock are convertible on an as-converted basis.

Shares Subject to the Plan

Except as set forth below, shares of Common Stock issued in connection with the exercise of, or as other payment for, an Award will be charged against the total number of shares issuable under the Plan.

In order to reflect such events as stock dividends, stock splits, recapitalization, mergers, consolidations or reorganizations by the Company, the Committee may, in its sole discretion, adjust the number of shares subject to each outstanding Award, the exercise price and the aggregate number of shares from which grants or awards may be made.

Change in Control

Upon a Change in Control (as defined in the Plan), each then-outstanding option and SAR shall automatically become fully vested, all restricted shares then outstanding shall automatically fully vest free of restrictions, and each other award granted under the Plan that is then outstanding shall automatically become vested and payable to the holder of such award unless the Administrator has made appropriate provision for the substitution, assumption, exchange or other continuation of the award pursuant to the Change in Control. Notwithstanding the foregoing, the Administrator, in its sole and absolute discretion, may choose (in an award agreement or otherwise) to provide for full or partial accelerated vesting of any award upon a Change In Control (or upon any other event or other circumstance related to the Change in Control, such as an involuntary termination of employment occurring after such Change in Control, as the Administrator may determine), irrespective of whether such any such award has been substituted, assumed, exchanged or otherwise continued pursuant to the Change in Control.

Certain Federal Income Tax Consequences

To the extent then required by applicable law or any applicable stock exchange or required under Sections 162, 422 or 424 of the Code to preserve the intended tax consequences of this Plan, or deemed necessary or advisable by the Board, the Plan and any amendment to the Plan shall be subject to stockholder approval.

Certain awards that are either granted or become vested, exercisable or payable based on attainment of one or more performance goals related, as well as Qualifying Options and Qualifying SARs granted to persons that are approved by a committee composed solely of two or more outside directors (as this requirement is applied under Section 162(m) of the Code) shall be deemed to be intended as performance-based compensation within the meaning of Section 162(m) of the Code unless such committee provides otherwise at the time of grant of the award. It is the further intent of the Corporation that (to the extent the Corporation or one of its Subsidiaries or awards under this Plan may be or become subject to limitations on deductibility under Section 162(m) of the Code) any such awards and any other Performance-Based Awards that are granted to or held by a person subject to Section 162(m) will qualify as performance-based compensation or otherwise be exempt from deductibility limitations under Section 162(m).

11

The Board intends that, except as may be otherwise determined by the Administrator, any awards under the Plan are either exempt from or satisfy the requirements of Section 409A of the Code and related regulations and Treasury pronouncements (“Section 409A”) to avoid the imposition of any taxes, including additional income or penalty taxes, thereunder. If the Administrator determines that an award, award agreement, acceleration, adjustment to the terms of an award, payment, distribution, deferral election, transaction or any other action or arrangement contemplated by the provisions of the Plan would, if undertaken, cause a participant’s award to become subject to Section 409A, unless the Administrator expressly determines otherwise, such award, award agreement, payment, acceleration, adjustment, distribution, deferral election, transaction or other action or arrangement shall not be undertaken and the related provisions of the Plan and/or award agreement will be deemed modified or, if necessary, rescinded in order to comply with the requirements of Section 409A to the extent determined by the Administrator without the content or notice to the participant. Notwithstanding the foregoing, neither the Company nor the Administrator shall have any obligation to take any action to prevent the assessment of any excise tax or penalty on any participant under Section 409A and neither the Company nor the Administrator will have any liability to any participant for such tax or penalty.

Although the Company intends that awards under the Plan will be exempt from, or will comply with, the requirements of Section 409A of the Code, the Company does not warrant that any award under the Plan will qualify for favorable tax treatment under Section 409A of the Code or any other provision of federal, state, local or foreign law. The Company shall not be liable to any participant for any tax, interest or penalties the participant might owe as a result of the grant, holding, vesting, exercise or payment of any award under the Plan

MERGER OF SILVER HORN MINING LTD., A DELAWARE CORPORATION, WITH AND INTO GREAT WEST RESOURCES, INC. A NEVADA CORPORATION

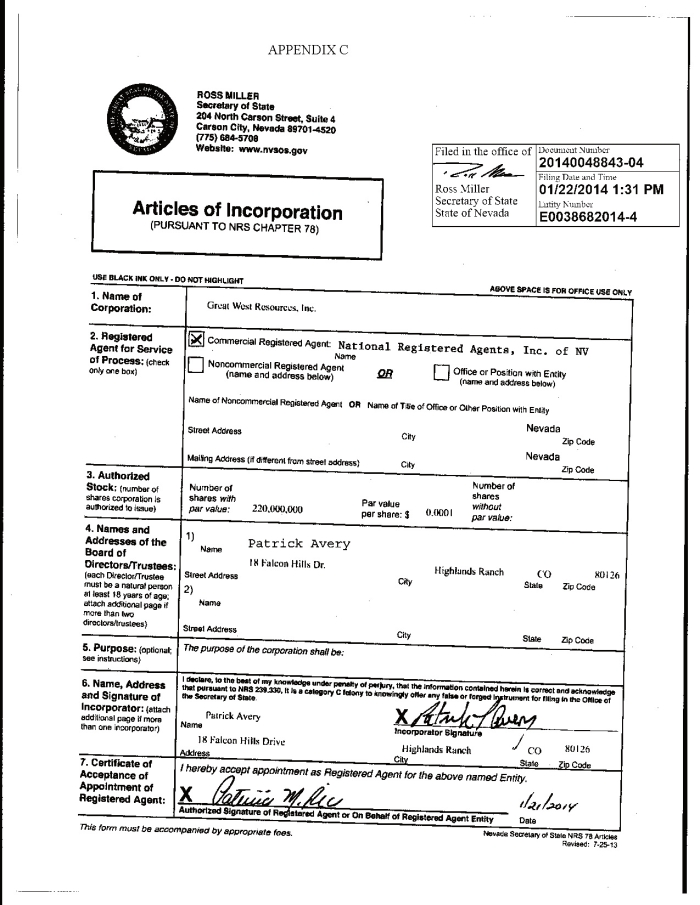

On January 21, 2014, the Company’s Board of Directors voted unanimously to approve the change in domicile from Delaware to Nevada (the “Reincorporation”) and recommended the Reincorporation to its Stockholders for their approval. On January 21, 2014, the holders of in excess of 90% of the outstanding voting stock consented in writing to approve the Reincorporation. The Reincorporation will be consummated pursuant to an Agreement and Plan of Merger between the Company and Great West Resources, Inc. (“Great West”), a copy of which is contained in Appendix B (the “Agreement and Plan of Merger”). Copies of Great West’s amended and restated articles of incorporation, as amended to date (“Nevada Articles”) and bylaws (“Nevada Bylaws”), are attached hereto as Appendix C and Appendix D, respectively. The Agreement and Plan of Merger provides that the Company will be merged with and into Great West.

The proposed Reincorporation will effect a change in the legal domicile of the Company and other changes of a legal nature, the most significant of which are described below. However, the Reincorporation will not result in any change in the Company’s business, management, location of its principal executive offices, assets, liabilities or net worth (other than as a result of the costs incident to the Reincorporation, which are immaterial). The Company’s Common Stock will continue to trade without interruption on the Over-the-Counter Bulletin Board.

Great West Resources, Inc.

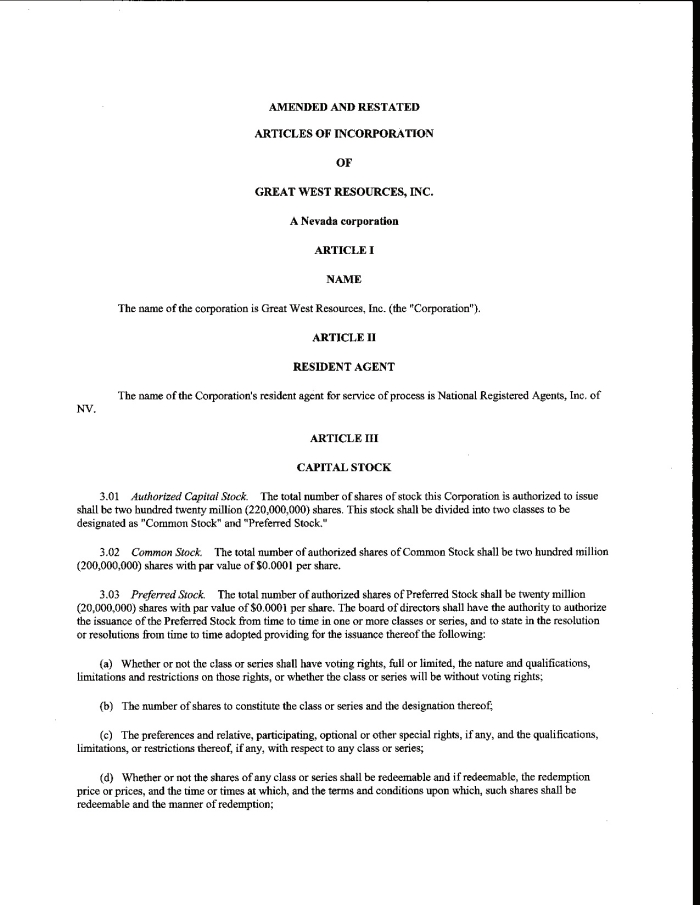

Great West, which will be the surviving corporation in the Merger, was incorporated by the Company under the Nevada Revised Statutes (“NRS”) on January 22, 2014, exclusively for the purpose of merging with the Company. The authorized capital of Great West consists of 220,000,000 shares of common stock, par value $0.0001 per share (“Great West Common Stock”), and 20,000,000 shares of preferred stock, par value $0.0001 per share (“Great West Preferred Stock”), of which 20,000 shares have been designated as Series A Convertible Preferred Stock, the rights and preferences of which are set forth in a Certificate of Designation, a copy of which is annexed hereto as Appendix E (“Great West Series A Preferred Stock”) and 30,000 shares have been designated as Series B Preferred Stock, the rights and preferences of which are set forth in a Certificate of Designation, a copy of which is annexed hereto as Appendix F (“Great West Series B Preferred Stock” and, together with the Great West Series A Preferred Stock, the “Great West Preferred Stock”).

12

Immediately prior to the closing of the Merger, Great West had one thousand shares of Great West Common Stock issued and outstanding, which were all held by the Company. The terms of the Merger Agreement provide that the currently issued and outstanding share of Great West Common Stock will be cancelled. As a result, following the Merger, the Company’s current Stockholders will be the only Stockholders of the newly merged company.

Filing of the Articles of Merger and Certificate of Merger

The Company intends to file Articles of Merger and a Certificate of Merger with the Secretary of State of Nevada and Delaware, respectively, when the actions taken by the Company’s Board of Directors and Stockholders become effective, which will be on or about *, 2014, which is at least 20 days from the mailing of this Information Statement to the Stockholders of record on the Record Date.

Effect of the Merger and Resulting Reincorporation

Under the NRS and the DGCL, when the Merger and resulting Reincorporation takes effect:

|

•

|

The Company, a Delaware corporation, merges with and into the surviving entity, Great West, and the separate existence of the Company ceases;

|

|

|

•

|

The title to all real estate and other property owned by the Company is vested in the surviving entity without reversion or impairment;

|

|

|

•

|

A proceeding pending against the Company may be continued as if the Merger had not occurred or the surviving entity may be substituted in the proceeding for the entity whose existence has ceased;

|

|

|

•

|

The stockholders’ interests of the Company and the other interest, obligations and other securities of the Company are converted into stockholders’ interests, obligations or other securities of the surviving entity, or into cash or other property, and the former holders of such interests are entitled only to the rights provided in the Articles of Merger and Articles of Incorporation of the surviving entity pursuant to the NRS, other than the right of certain stockholders to seek appraisal of the fair value of their shares under provisions of the DGCL dealing with dissenter’s rights.

|

On the effective date of the Merger, the Company will be deemed incorporated under the NRS. Consequently, the Company will be governed by the Nevada Certificate and Nevada Bylaws.

Principal Reasons for the Change of Domicile

Nevada is a nationally recognized leader in adopting and implementing comprehensive and flexible corporation laws that are frequently revised and updated to accommodate changing legal and business needs. In light of our growth, our Board of Directors believes that it will be beneficial to the Company and its stockholders to obtain the benefits of Nevada’s corporation laws. Nevada courts have developed considerable expertise in dealing with corporate legal issues and have produced a substantial body of case law construing Nevada corporation laws. Because the judicial system is based largely on legal precedents, the abundance of Nevada case law should serve to enhance the relative clarity and predictability of many areas of corporation law, and allow our Board of Directors and management to make business decisions and take corporate actions with greater assurance as to the validity and consequences of such decisions and actions.

In addition, we anticipate that the Reincorporation will result in reduced state tax obligations, as Nevada currently imposes no corporate income or franchise tax, while Delaware imposes an annual franchise tax, ranging from a nominal amount to a maximum of $180,000. Our franchise tax obligation for 2013 shall be the maximum $180,000. Nevada imposes a nominal amount of annual corporate fee on corporations. Based on Great West’s current authorized shares, we anticipate that its obligation for the Nevada annual corporate fee will be less than $400. Further, we expect that the Reincorporation will make our securities more attractive to investors as Nevada is the standard state of incorporation for companies that operate in the natural resources and mining sector.

13

Principal Features of the Reincorporation

The Reincorporation will be effected by the Merger of the Company, a Delaware corporation, with and into, Great West, a newly formed wholly-owned subsidiary of the Company that was incorporated on January 22, 2014 under the NRS for the purpose of effecting the Reincorporation. The Reincorporation will become effective upon the filing of the requisite merger documents in Nevada and Delaware. Following the Merger, Great West will be the surviving corporation and will operate under the name “Great West Resources, Inc.”

On the effective date of the Merger:

(a) Each share of Silver Horn Common Stock issued and outstanding immediately prior to the effective date shall be changed and converted into 1/150th fully paid and nonassessable shares of Great West Common Stock;

(b) Each share of Silver Horn Series A Preferred Stock issued and outstanding immediately prior to the effective date shall be changed and converted into 1/150th fully paid and nonassessable shares of the Great West Series A Preferred Stock;

(c) Each share of Silver Horn Series D Preferred Stock issued and outstanding immediately prior to the effective date shall be changed and converted into 1/150th fully paid and nonassessable shares of the Great West Series B Preferred Stock;

(d) All options to purchase shares of Silver Horn Common Stock that are issued and outstanding immediately prior to the effective date shall be changed and converted into equivalent options to purchase 1/150th of a share of Great West Common Stock at an exercise price of $0.0001 per share;

(e) All warrants to purchase shares of Silver Horn Common Stock that are issued and outstanding immediately prior to the effective date shall be changed and converted into equivalent warrants to purchase 1/150th of a share of Great West Common Stock at 150 times the exercise price of such converted warrants; and

(f) Each share of Great West Common Stock issued and outstanding immediately prior to the Effective Date shall be canceled and returned to the status of authorized but unissued Great West Common Stock.

In lieu of issuing fractional shares of Great West Common Stock or Great West Preferred Stock or options or warrants to purchase fractional shares of Great West Common Stock, to the extent that a holder’s shares of Silver Horn Common Stock, Silver Horn Series A Preferred Stock or Silver Horn Series D Preferred Stock, when aggregated together with shares of the same class, do not convert to whole shares of Great West Common Stock, Great West Series A Preferred Stock or Great West Series B Preferred Stock, as applicable, the resulting fractional shares shall be rounded up to the closest full share, and all options and warrants to purchase fractional shares of Great West Common Stock shall be rounded up to purchase the next full share of Great West Common Stock. For example, a holder of 6,000,000 shares of Silver Horn Common Stock, 150,000 shares of Silver Horn Series A Preferred Stock, 40,000 shares of Silver Horn Series D Preferred Stock, options to purchase 4,500,000 shares of Silver Horn Common Stock and warrants to purchase 2,000,000 shares of Silver Horn Common Stock would receive 40,000 shares of Great West Common Stock, 1,000 shares of Great West Series A Preferred Stock, 267 shares of Great West Series B Preferred Stock, options to purchase 30,000 shares of Great West Common Stock and warrants to purchase 13,334 shares of Great West Common

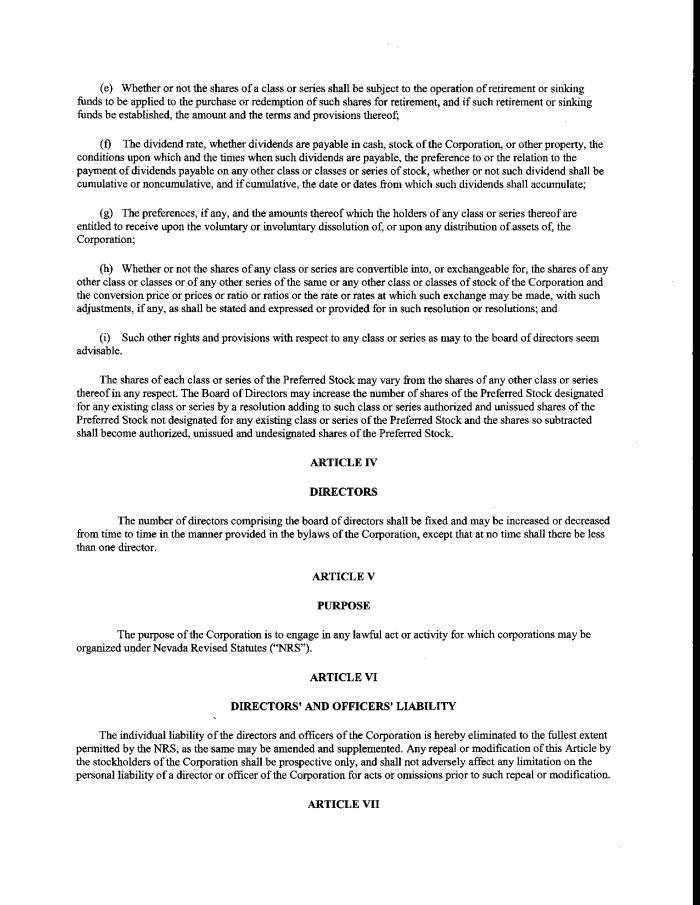

At the effective date of the Merger, Great West will be governed by the Nevada Articles (including the Certificate of Designation for the Great West Series A Preferred Stock and the Certificate of Designation for the Great West Series B Preferred Stock), the Nevada Bylaws and the NRS, which include a number of provisions different from those in the Company’s Certificate of Incorporation, bylaws or the DGCL. Accordingly, as described below, a number of changes in stockholders’ rights will occur in connection with the Reincorporation, some of which may be viewed as limiting the rights of Stockholders.

Upon consummation of the Merger and resulting Reincorporation, the daily business operations of Great West will continue as they are presently conducted by the Company, at the Company’s principal executive offices at 18 Falcon Hills Drive, Colorado 80126. The officers of the Company will become the officers of Great West. The members of the Company’s Board of Directors will become the directors of Great West.

14

Pursuant to the terms of the Merger Agreement, the Merger may be abandoned by the Board of Directors of the Company and Great West at any time prior to the effective date of the Merger. In addition, the Board of Directors of the Company may amend the Merger Agreement at any time prior to the effective date of the Merger provided that any amendment made may not, without approval by the Stockholders of the Company who have consented in writing to approve the Merger, alter or change the amount or kind of Great West Common Stock or Great West Preferred Stock to be received in exchange for or on conversion of all or any of the Common Stock or Preferred Stock, respectively, alter or change any term of the Nevada Articles or alter or change any of the terms and conditions of the Merger Agreement if such alteration or change would adversely affect the holders of Common Stock or the holders of the Preferred Stock.

Great West Share Certificates

After the effective date of the merger, (i) certificates representing shares of Silver Horn Common Stock will represent shares of Great West Common Stock, (ii) certificates representing shares of Silver Horn Series A Preferred Stock will represent shares of Great West Series A Preferred Stock and (iii) certificates representing shares of Silver Horn Series D Preferred Stock will represent shares of Great West Series B Preferred Stock, and without surrender of the same to the transfer agent for Silver Horn, who also shall serve as the transfer agent for Great West, the holder thereof shall be entitled to receive a certificate or certificates representing the number of shares of Great West Common Stock, Great West Series A Preferred Stock or Great West Series B Preferred Stock into which such shares of Silver Horn Common Stock, Silver Horn Series A Preferred Stock and Silver Horn Series D Preferred Stock shall have been converted.

Failure by a Stockholder to surrender certificates representing Common Stock or Preferred Stock will not affect such person’s rights as a Stockholder, as such stockholder certificate representing Common Stock or Preferred Stock, respectively, following the Reincorporation will represent the right to receive shares of Great West Common Stock or Great West Preferred Stock, respectively.

Capitalization

The authorized capital of the Company, on the Record Date, consisted of 750,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock, of which 3,000,000 shares are designated as Series A Preferred Stock. As of the Record Date, there were 3,000,000 shares of the Company’s Series A Preferred Stock issued and outstanding. The authorized capital of Great West, which will be the authorized capital of the Company after the Reincorporation, will consist of 200,000,000 shares of Great West Common Stock and 20,000,000 shares of Great West Preferred Stock, of which 20,000 shares will be designated as Great West Series A Preferred Stock and 30,000 shares will be designation as Great West Series B Preferred Stock.

After the Merger, Great West will have outstanding approximately 1,510,976 shares of Great West Common Stock, 26,667 shares of Great West Preferred Stock, of which 20,000 shares shall be Great West Series A Preferred Stock and 6,667 shares shall be Great West Series B Preferred Stock.

The Great West board of directors may in the future authorize, without further stockholder approval, the issuance of such shares of Great West Common Stock or Great West Preferred Stock to such persons and for such consideration upon such terms as the Great West board of directors determines. Such issuance could result in a significant dilution of the voting rights and, possibly, the stockholders’ equity, of then existing stockholders.

Significant Differences Between the Corporation Laws of Nevada and Delaware

The Company is incorporated under the laws of the State of Delaware and Great West is incorporated under the laws of the State of Nevada. Upon consummation of the Merger and Reincorporation, the Stockholders of the Company, whose rights currently are governed by Delaware law and the Company’s certificate of incorporation and bylaws, which were created pursuant to Delaware law, will become stockholders of a Nevada company, Great West Resources, Inc., and their rights as stockholders will then be governed by Nevada law and the Nevada Articles and Nevada Bylaws which were created under Nevada law.

15

Certain differences exist between the corporate statutes of Nevada and Delaware. The most significant differences, in the judgment of the management of the Company, are summarized below. This summary is not intended to be complete, and stockholders should refer to the DGCL and the NRS to understand how these laws apply to the Company and Great West Resources, Inc.

The Company was incorporated under the laws of the State of Delaware and Great West was incorporated under the laws of the State of Nevada. Our shareholders will become shareholders of Great West. Your rights as shareholders will be governed by the Title 7, Chapter 78 of the NRS and the articles of incorporation and bylaws of Great West rather than the DGCL and certificate of incorporation and bylaws of the Company. The articles of incorporation and bylaws of Great West are set forth in Appendix C and Appendix D, respectively.

The corporate statutes of Nevada and Delaware have various differences, some of which are summarized below. This summary is not intended to be complete, and is qualified by reference to the full text of, and decisions interpreting, Delaware law and Nevada law.

|

Delaware

|

Nevada

|

|

Removal of Directors

|

|

|

The DGCL permits the holders of a majority of shares of a corporation without a classified board then entitled to vote in an election of directors to remove directors, with or without cause. Our current Bylaws align with the DGCL.

|

Under Nevada law, any one or all of the directors of a corporation may be removed, with or without cause, by the holders of not less than two-thirds of the voting power of a corporation’s issued and outstanding stock. Great West’s Bylaws align with Nevada law.

|

|

Dividends and other Distributions

|

|

|

Section 170 of the DGCL permits the directors of a corporation, subject to any restrictions contained in its certificate of incorporation, to declare and pay dividends upon the shares of its capital stock, either (1) out of its surplus, as computed in accordance with the DGCL, or (2) in case there is no surplus, out of its net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. But such dividends cannot be declared out of net profits if the capital of the corporation has diminished by depreciation in the value of its property, or by losses or otherwise, to an amount less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets.

|

Nevada law prohibits distributions to stockholders when the distributions would (i) render the corporation unable to pay its debts as they become due in the usual course of business and (ii) render the corporation’s total assets less than the sum of its total liabilities plus the amount that would be needed to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution.

|

|

Section 174 of the DGCL also imposes on any director under whose administration distributions are declared in violation of the foregoing provision, personal liability to a corporation’s creditors in the event of its dissolution or insolvency, up to the full amount of the unlawful distribution, for a period of 6 years following a dividend declaration, unless such director’s dissent was recorded in the minutes of the proceedings approving the distribution.

|

Section 78.300 of the Nevada Revised Statutes imposes on any director under whose administration distributions are declared in violation of the foregoing provision, personal liability to a corporation’s creditors in the event of its dissolution or insolvency, up to the full amount of the unlawful distribution, for a period of 3 years following a dividend declaration, unless such director’s dissent was recorded in the minutes of the proceedings approving the distribution.

|

16

|

Limitation of Liability

|

|

|

A Delaware corporation is permitted to adopt provisions in its certificate of incorporation limiting or eliminating the liability of a director to a company and its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such liability does not arise from certain proscribed conduct, including breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law or liability to the corporation based on unlawful dividends or distributions or improper personal benefit. Our current Certificate of Incorporation currently limits the liability of its directors to the fullest extent permitted by law.

|

Under Nevada law, unless the articles of incorporation provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders for any damages as a result of any act or failure to act in his capacity as a director or office unless it is proven that: (a) his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and (b) his breach of those duties involved intentional misconduct, fraud or a knowing violation of law. Great West’s Articles of Incorporation limit the liability of its directors to the fullest extent permitted by law.

|

|

Indemnification

|

|

|

Under the DGCL, the indemnification of directors and officers is authorized to cover judgments, amounts paid in settlement, and expenses arising out of non-derivative actions where the director or officer acted in good faith and in or not opposed to the best interests of the corporation, and, in criminal cases, where the director or officer had no reasonable cause to believe that his or her conduct was unlawful. Unless limited or denied by the corporation’s certificate of incorporation, indemnification is required to the extent of a director’s or officer’s successful defense. Additionally, under the DGCL, a corporation may reimburse directors and officers for expenses incurred in a derivative action.

|

In suits that are not brought by or in the right of the corporation, Nevada law permits a corporation to indemnify directors, officers, employees and agents for attorney’s fees and other expenses, judgments and amounts paid in settlement. The person seeking indemnity may recover as long as he acted in good faith and believed his actions were either in the best interests of or not opposed to the best interests of the corporation. Similarly, the person seeking indemnification must not have had any reason to believe his conduct was unlawful.

|

|

However, we have included undertakings in various registration statements filed with the Securities and Exchange Commission that in the event a claim for indemnification is asserted by a director or officer relating to liabilities under the Exchange Act, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether indemnification would be against public policy and will be governed by any final adjudication of such issue.

|

In derivative suits, a corporation may indemnify its agents for expenses that the person actually and reasonably incurred. A corporation may not indemnify a person if the person was adjudged to be liable to the corporation unless a court otherwise orders.

No corporation may indemnify a party unless it makes a determination, through its stockholders, directors or independent counsel, that the indemnification is proper.

Great West’s Articles of Incorporation currently indemnify its officers and directors to the fullest extent permitted by Nevada law.

|

|

Great West, as successor to the Company in the Reincorporation, will abide by any undertakings made by the Company in registration statements or reports filed with the Securities and Exchange Commission that in the event a claim for indemnification is asserted by a director or officer relating to liabilities under the Exchange Act, Great West will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether indemnification would be against public policy and will be governed by any final adjudication of such issue.

|

|

17

|

Increasing or Decreasing Authorized Shares

|

|

|

Delaware law contains no such similar provision.

|

Nevada law allows the board of directors of a corporation, unless restricted by the articles of incorporation, to increase or decrease the number of authorized shares in the class or series of the corporation’s shares and correspondingly effect a forward or reverse split of any such class or series of the corporation’s shares without a vote of the stockholders, so long as the action taken does not change or alter any right or preference of the stockholder and does not include any provision or provisions pursuant to which only money will be paid or script issued to stockholders who hold 10% or more of the outstanding shares of the affected class and series, and who would otherwise be entitled to receive fractions of shares in exchange for the cancellation of all of their outstanding shares.

|

|

Corporate Opportunity

|

|

|

Delaware law provides that contracts or transactions between a corporation and one or more of its officers or directors or an entity in which they have an interest is not void or voidable solely because of such interest or the participation of the director or officer in a meeting of the board or a committee which authorizes the contract or transaction if: (i) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the board or the committee, and the board or the committee in good faith authorizes the contract or transaction by the affirmative vote of a majority of disinterested directors; (ii) the material facts as to the relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by a vote of the stockholders; or (iii) the contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified by the board of directors, a committee thereof, or the stockholders.

|

Under Nevada law, a director breaches her duty of loyalty to the corporation if the director takes a business opportunity that is within the scope of the corporation’s potential business for himself or presents it to another party without first giving the corporation an opportunity to fairly consider the business opportunity. All such opportunities should be presented first to the corporation and fully considered.

However, a contract or other transaction is not void or voidable solely because the contract or transaction is between a Nevada corporation and its director if the fact of financial interest is known to the board of directors or committee, and the board or committee authorizes, approves or ratifies the contract or transaction in good faith by a vote sufficient for the purpose without counting the vote of the interested director, and the contract or transaction is fair as to the corporation at the time it is authorized.

|

|

Expiration of Proxies

|

|

|

Section 212 of the DGCL provides that the appointment of a proxy with no expiration date may be valid for up to 3 years, but that a proxy may be provided for a longer period. Furthermore, a duly executed proxy may be irrevocable if it states that it is irrevocable and if, it is coupled with an interest in the stock itself or an interest in the corporation generally, sufficient in law to support an irrevocable power.

|

Nevada law provides that proxies may not be valid for more than 6 months, unless the proxy is coupled with an interest or the stockholder specifies that the proxy is to continue in force for a longer period, not to exceed 7 years.

|

18

|

Interested Stockholder Combinations

|

|

|

Delaware has a business combination statute, set forth in Section 203 of the DGCL, which provides that any person who acquires 15% or more of a corporation’s voting stock (thereby becoming an “interested stockholder”) may not engage in certain “business combinations” with the target corporation for a period of three years following the time the person became an interested stockholder, unless (i) the board of directors of the corporation has approved, prior to the interested stockholder’s acquisition of stock, either the business combination or the transaction that resulted in the person becoming an interested stockholder, (ii) upon consummation of the transaction that resulted in the person becoming an interested stockholder, that person owns at least 85% of the corporation’s voting stock outstanding at the time the transaction is commenced (excluding shares owned by persons who are both directors and officers and shares owned by employee stock plans in which participants do not have the right to determine confidentially whether shares will be tendered in a tender or exchange offer), or (iii) the business combination is approved by the board of directors and authorized by the affirmative vote (at an annual or special meeting and not by written consent) of at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

|

Section 78.438 of the Nevada Revised Statutes prohibits a Nevada corporation from engaging in any business combination with any interested stockholder (any entity or person beneficially owning, directly or indirectly, 10% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by any of these entities or persons) for a period of three years following the date that the stockholder became an interested stockholder, unless prior to that date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder.

Section 78.439 provides that business combinations after the three year period following the date that the stockholder becomes an interested stockholder may also be prohibited unless approved by the corporation’s directors or other stockholders or unless the price and terms of the transaction meet the criteria set forth in the statute.

|

|

For purposes of determining whether a person is the “owner” of 15% or more of a corporation’s voting stock for purposes of Section 203 of the DGCL, ownership is defined broadly to include the right, directly or indirectly, to acquire the stock or to control the voting or disposition of the stock. A business combination is also defined broadly to include (i) mergers and sales or other dispositions of 10% or more of the assets of a corporation with or to an interested stockholder, (ii) certain transactions resulting in the issuance or transfer to the interested stockholder of any stock of the corporation or its subsidiaries, (iii) certain transactions which would result in increasing the proportionate share of the stock of a corporation or its subsidiaries owned by the interested stockholder, and (iv) receipt by the interested stockholder of the benefit (except proportionately as a stockholder) of any loans, advances, guarantees, pledges or other financial benefits.

These restrictions placed on interested stockholders by Section 203 of the DGCL do not apply under certain circumstances, including, but not limited to, the following: (i) if the corporation’s original certificate of incorporation contains a provision expressly electing not to be governed by Section 203 or (ii) if the corporation, by action of its stockholders, adopts an amendment to its bylaws or certificate of incorporation expressly electing not to be governed by Section 203, provided that such an amendment is approved by the affirmative vote of not less than a majority of the outstanding shares entitled to vote and that such an amendment will not be effective until 12 months after its adoption (except for limited circumstances where effectiveness will occur immediately) and will not apply to any business combination with a person who became an interested stockholder at or prior to such adoption.

|

|

19

|

Control Share Acquisitions

|

|

|

Delaware’s control share acquisition statute generally provides that shares acquired in a “control share acquisition” will not possess any voting rights unless either the board of directors approves the acquisition or such voting rights are approved by a majority of the corporation’s voting shares, excluding interested shares. Interested shares are those held by a corporation’s officers and inside directors and by the acquiring party. A “control share acquisition” is an acquisition, directly or indirectly, by any person of ownership of, or the power to direct the exercise of voting power with respect to, issued and outstanding “control shares” of a publicly held Delaware corporation. “Control shares” are shares that, except for Delaware’s control share acquisition statute, would have voting power that, when added to all other shares that can be voted by the acquiring party, would entitle the acquiring party, immediately after the acquisition of such shares, directly or indirectly, to exercise voting power in the election of directors within any of the following ranges: (1) at least 20% but less than 33 1/3% of all voting power; (2) at least 33 1/3% but less than a majority of all voting power; or (3) a majority or more of all voting power.

|

Sections 78.378 through 78.3793 of the Nevada Revised Statutes limit the voting rights of certain acquired shares in a corporation. The provisions generally apply to any acquisition of outstanding voting securities of a Nevada corporation that has 200 or more stockholders, at least 100 of which are Nevada residents, and conducts business in Nevada (an “issuing corporation”) resulting in ownership of one of the following categories of an issuing corporation's then outstanding voting securities: (i) 20% or more but less than 23%; (ii) 23% or more but less than 50%; or (iii) 50% or more. The securities acquired in such acquisition are denied voting rights unless a majority of the security holders approve the granting of such voting rights. Unless an issuing corporation’s articles of incorporation or bylaws then in effect provide otherwise: (i) voting securities acquired are also redeemable in part or in whole by an issuing corporation at the average price paid for the securities within 30 days if the acquiring person has not given a timely information statement to an issuing corporation or if the stockholders vote not to grant voting rights to the acquiring person's securities, and (ii) if outstanding securities and the security holders grant voting rights to such acquiring person, then any security holder who voted against granting voting rights to the acquiring person may demand the purchase from an issuing corporation, for fair value, all or any portion of his securities.

|

|

Taxes and Fees

|

|

|

Delaware imposes annual franchise tax fees on all corporations incorporated in Delaware. The annual fee ranges from a nominal fee to a maximum of $180,000, based on an equation consisting of the number of shares authorized, the number of shares outstanding and the net assets of the corporation. Our franchise tax obligation for 2013 shall be $180,000.

|

Nevada charges corporations incorporated in Nevada nominal annual corporate fees based on the corporation’s authorized stock, as well as a $200 business license fee, and does not impose any franchise taxes on corporations. Based on Great West’s current authorized shares, we anticipate that Great West’s obligation for the annual corporate fee will be less than $400.

|

|

Preferred Stock

|

|

|

Section 242 of the DGCL provides that after a corporation has issued classes or series of preferred stock, the designation of the class or series, the number of the class or series and the voting powers, designations, preferences, limitations, restrictions and relative rights of the class or series may be amended by a resolution of the board of directors and the proposed amendment adopted by the board of directors must be approved by the vote of stockholders holding shares in the corporation entitling them to exercise a majority of the voting power.

The Company’s Certificate of Incorporation aligns with Delaware law.

|